Executive Summary

The India Travel report outlines reasons for the emergence of the Car Rental industry in India, in light of the current context of the pandemic. It is no secret that the current COVID pandemic in 2020 is something truly unprecedented in modern times. The disruption it has caused has left no industry untouched. The Travel and Tourism sector is amongst the hardest hit, with a staggering 60% to 80% slump in global demand [1], compared to 2019.

However, China, a country that is arguably most ahead in the COVID-19 chronology curve, is slowly witnessing green shoots of recovery. A study by McKinsey on post COVID travel trends in China shows that revival has been swift, and the quantum of revival has been quite promising [2]. A 46% increase in the tourist count was observed from April to May, over the two recent national holidays, indicative of a pent-up demand and a perennial desire to travel [3]. The study also highlights the destination and mobility preferences of travelers, with domestic travel and car rentals bagging top honours respectively.

India still remains in the thick of the pandemic, and its travel sector, led by the Airlines and the Hotel/Hospitality verticals are witnessing record downturns. With it, the entire travel commerce industry is looking for alternate sources of revenue to augment their core shortfalls.

The India Travel report outlines reasons for the emergence of the Car Rental industry in India, in light of the current context of the pandemic. With unique advantages like safety, privacy and door to door convenience, as well as a conscious push by the central and state governments towards domestic tourism, there is a compelling argument to be made that Car Rentals will be the front-runners in shaping the future of travel, mobility and tourism in a post-pandemic India. The paper borrows from early trends in China, surveys and subjective evidence from India as well as well-known advantages of car rentals that are contextualized against the needs and demands of the post-COVID scenario to articulate its arguments. It finally uses empirical evidence of demand patterns observed at Savaari Car Rentals to validate the claims made in this India travel report.

Travel trends in China – ‘This too has passed ’

The worst impact of COVID-19 has passed in China. Offices, schools, factories, shopping malls and tourist destinations have reopened as people started to feel more confident about stepping out of homes. While the economy has been sluggish, people did not hesitate to celebrate their new found freedom during the first set of major national holidays since the lockdown was lifted.

Revival of demand in Travel/Tourism

Tomb Sweeping Day, a three day weekend in early April, witnessed a daily traffic of 14 million travelers. While the count was significantly low when compared to the same holiday in 2019, the demand quickly picked up in the May holiday.

The National Labour Day in May was an extended five day holiday where the travel figures more than doubled to 115 million trips from merely 43 million trips taken in April [4]. The two consecutive long holidays in 2020 registered a 46% growth, compared to 34% in 2019.

Source: China Briefing: Tourism revival over Labour Day

Travelers go local as international travel tumbles

Due to the international travel restrictions and safety concerns of people, travel preferences remained strictly domestic. Most travelers opted for shorter trips or city breaks for vacationing. The choice of destination was largely determined by the distance from the hometown, seeing a shift from the traditionally popular holiday destinations such as Sanya and Xiamen to the easily drivable Shanghai, Guangzhou and Beijing.

As per a report by Lvmama, a travel agency in China, Staycations gained popularity with 30% of its customers traveling in their hometown and 40% going for intra-provincial destinations [4].

Car rentals emerged as the preferred choice of mobility

As people preferred closer, drivable destinations for vacations, flying for domestic trips was very limited. Destinations such as Nanjing and Changsha also gained popularity as they are well-connected by highways.

“During the May Day holiday, a daily average drop of 60.9% in the national railways passengers was recorded compared to the same period in 2019. But for the national highway traffic, the drop in the daily traffic volume was only 7.76%”, a report by the Ministry of Transport of China reads [5].

Ministry of Transport: May Day records 121M passengers

Research by Trip.com, an international online travel agency, indicates that 60% of the travelers during the May holiday opted for car travel resulting in 10% increase in car rentals demand compared with the same period last year [6].

In fact, self-guided tours with rented cars was the top preference of people as they involved minimal contact with people, simultaneously complimenting their choice of closer-to-home holiday destinations.

Travel trends in India – ‘To move or not to move ’

Impact of COVID-19 on Indian Travel and Tourism industry

The travel and tourism industry in India, similar to the rest of the world, has taken the worst hit in the face of the pandemic. The various travel restrictions imposed by the government to contain the spread of coronavirus has led to the shutting down of hotels, suspension of the airlines, travel and tour operators, and travel agencies across the country.

As per the Confederation of Indian Industry (CII), India’s tourism sector may suffer a revenue loss of ₹ 1.58 lakh crores with 40-50 million jobs at risk[7]. The headlines dominating the travel industry in India revolve around furloughs, layoffs, cancelled mergers and category rationalization.

Government advocates Domestic Tourism

The state and central governments of India are boldly advocating domestic tourism as an attempt to revive the decline in demand and revenues from the travel and hospitality sector in Q1 of FY-21. As a part of the PMO’s ‘Vocal for Local’ and ‘Atma-nirbhar’ campaigns, the government has provided strong indicators to boost small businesses and travel operators who focus on domestic tours.

The Tourism Ministry of India recently launched an initiative called ‘Dekho Apna Desh’, which offers virtual traveling experiences to stunning Indian destinations[8]. Tourism Minister of Karnataka, CT Ravi, has also proposed an initiative to boost local and inter-district tourism under the campaign ‘Nodu Baa Nammooru’ (Come, see our city).

The government’s focus on domestic travel and the interest of people to travel to nearby, offbeat and often under-explored locations are indicative of the return of the road trips and the popularity of staycations. While there seems to be a strong intent in promoting local tourism, it remains to be seen how this translates into concrete policy rollouts.

The Aviation industry crash-lands

Financially, the fallout from COVID-19 is the biggest in the history of the aviation industry. With international borders sealed and long-haul travel still questionable, airlines are primarily dependent on short-haul domestic travel for revenues.

Revenue losses worth ₹ 25,000 crores are speculated in calendar year 2020 for airlines and airport operators, as per the estimates by CRISIL [9].

Air travel constitutes anywhere between 60% and 90% of the gross bookings for the integrated domestic travel commerce community. The heavy dependence on air ticketing has left large online travel agents (OTAs) as well as thousands of medium and small travel agents incurring significant losses with airlines freezing over ₹ 4,200 crores worth of refunds [9].

Hotel occupancy suffers – Check-outs but no check-ins

The severe drop in business and leisure travel demands has created a lasting void in the hospitality industry. The cash break-even occupancy (the level of occupancy required for a hotel to achieve zero gain or loss in profit) for premium hotels is close to 40%. Currently, the hotels in India are operating at 10% to 15% occupancy, translating to a revenue decline of 30% to 50% per available room [10]. Mid-range and economy hotels are also experiencing similar degrees of occupancy and revenue declines.

As per a report by HVS and Anarock, a total revenue loss of ₹ 90,000 crores is estimated for the hotel industry in the country during this calendar year[11]. While some hotels have resorted to pay-cuts and layoffs to mitigate the losses, others have permanently shut down.

Heavy dependency of Indian travel commerce on Air and Hotels

Travel commerce in India is dominated primarily by large online travel agencies (OTAs) on one side, and a large semi-organized and unorganized network of travel agents on the other. It is a reasonable assertion to state that a bulk of their revenues are driven by air ticketing and hotel booking services.

OTA giants such as MakeMyTrip, Yatra, Cleartrip and Goibibo have witnessed a substantial decline in demands as two-third of their gross merchandise volume (GMV) are airline bookings, followed by hotels and bus ticket bookings.

Air ticketing accounts for 58% of MakeMyTrip’s gross bookings; and the number goes as high as 90% for travel giants such as Yatra & Cleartrip[9]. The dependency becomes nearly 100% as one moves from these organized players to the large unorganized network of travel agents.

TechCircle: Pandemic exposes vulnerabilities in OTAs

Consequently, the OTA industry has contributed to a large slice of furloughs and layoffs in May and June, with industry experts believing that the worst is still to come. The smaller travel agents, on the other hand are on a self-imposed lockdown, with their retail offices remaining shut due to near zero footfalls.

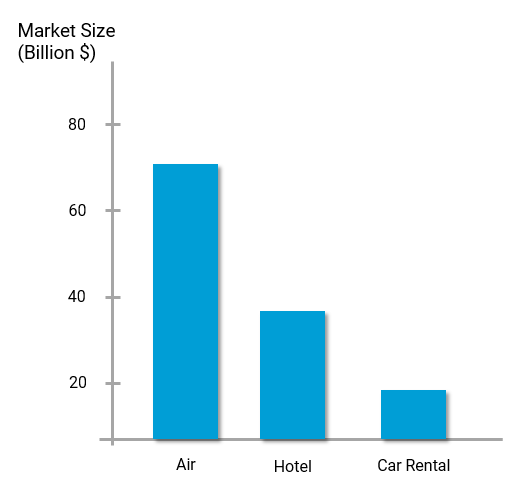

How the Car Rental market stacks up against traditional behemoths

It may be surprising to some but the Indian Car Rental industry is a $15-$20B industry, dominated largely by unorganized players. Often ignored, the category’s size makes it a significant contributor to Indian travel along with the traditional big two – Aviation (at $70B) and Hotels (at $25B). With the aviation and hotel verticals currently in doldrums, we posit that the Car Rental industry, due to uniquely inherent advantages, can help control the decline.

This is evident from the car rental recovery in China where the sector has already recovered 70% of its business compared to the last year. Leo Cai, executive VP of EHI Car Services[12], says, “The total number of bookings has already exceeded last year. But the price (sic) isn’t 100% there. For the May Day holiday, our total revenue nearly matched last year.“

Most of the large OTAs have accelerated expanding their category offerings to include car rentals over the last two months to diversify their revenue streams and capitalize on the immediate demand. A similar push is also being witnessed in the unorganized travel agent network, with creative and low-cost solutions for car rental integration being implemented aggressively.

The organized cab rental industry, a sunrise sector, has been the most stable in terms of bookings generated during Q1 of FY-21.

Changing demands in mobility – Unique advantages of Car Rentals

It is safe to say that the pandemic is fundamentally going to change the way people commute and travel. In the short term, standards of safety, security and reliability will be so accentuated that they will soon become the norm. It is imperative that the various means of transport quickly adopt and adapt. It is here that Car Rentals have inherent advantages towards meeting the necessary expectations and instilling confidence in commuters. Furthermore, public transportation in India, that has traditionally been lax on safety parameters, is expected to forfeit patronage to rental services.

“70% of the people would avoid public transport such as buses, trains, metro rails and even three-wheelers (autorickshaw) for the fear of infection as these vehicles carry other passengers throughout the day”, a survey by Livemint in Bengaluru, concluded[13].

Livemint: 70% Indians to avoid public transport post lockdown

“62% people said they would avoid on-demand, cab hailing services like Uber and Ola”, the Livemint survey added[13].

Livemint: 70% Indians to avoid public transport post lockdown

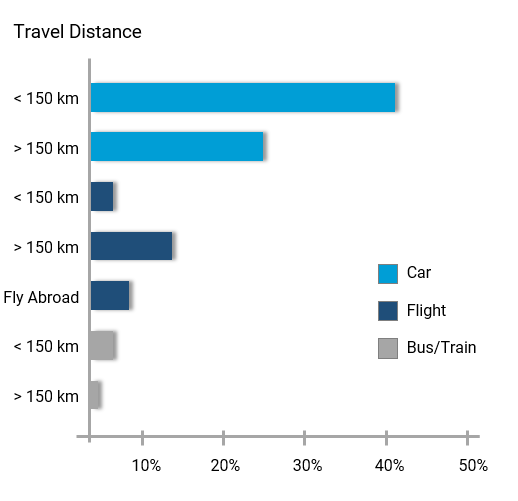

Research by Skift, a travel media company, indicates that 67% of the people will take their first post-COVID trip by car, 20% will prefer air, and less than 5% will opt for train or bus [14].

Below are salient advantages that positions car rentals as a germane mode of transport in a post-pandemic India:

- Dedicated spaces – This provision of dedicated spaces for commuter groups alleviates safety concerns that arise due to the concurrently shared assets in the case of trains, buses, airlines and pooled/shared cabs.

- Door to Door services – With public spaces posing the highest risk of infection spread, the door to door service advantage that car rentals offer circumvents any need for commuters to be exposed to the aforementioned high-risk infection zones like airports, railway stations and bus stands.

- Entrepreneurial ownership – The ownership of cabs are either by individual ‘driver cum owners’ or small ‘car rental vendors’. This localized ownership brings in a heightened responsibility towards maintaining hygiene and safety protocols in their respective vehicles. The logistics in equipping a cab with sanitizers, masks, temperature guns and disinfectants is far more manageable in this mode of decentralized ownership.

- Customizable service offerings – Offerings like hourly rentals and multi-day packages provide commuters with greater flexibility to customize their itineraries. This is in stark contrast to the ‘one size fits all’ standardized fare and commoditized service model (that sell seats rather than travel services) offered by traditional means of transport.

- Last mile connectivity – With ubiquitous penetration of highways and permanent roads into every corner of the country, accessibility that road travel offers is several quanta higher than all other modes.

Car Rental recovery through Savaari’s lens – ‘Calm after the storm? ’

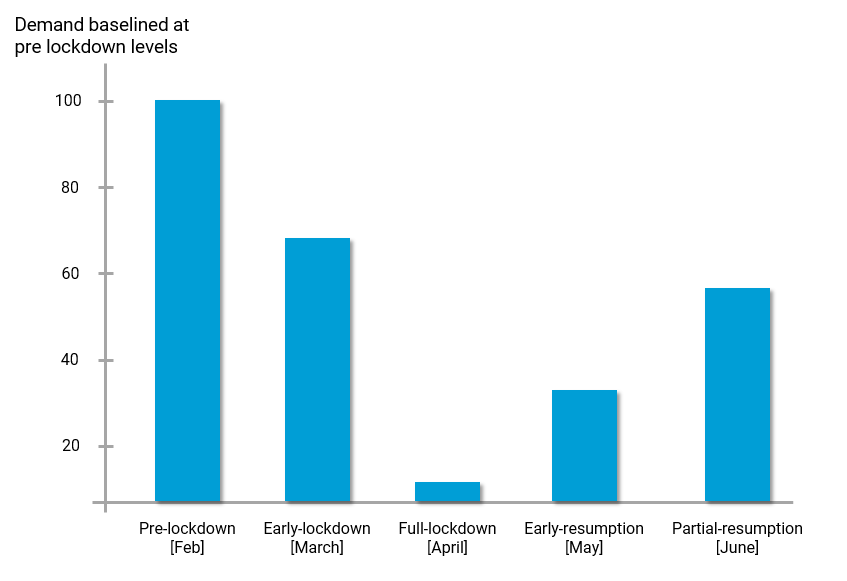

With the first quarter of FY-21 behind us, Savaari Car Rentals’ monthly demand trend depicts an interesting narrative; a narrative that can be used in drawing parallels as well as contrasts with the larger domestic travel industry. The months starting from Feb-2020 are represented as five distinct phases to articulate the inferences.

- Feb – Pre-lockdown

- March – Early lockdown

- April – Full lockdown

- May – Early resumption

- June onwards – Partial resumption

It is noteworthy that the road to recovery from late April to early June is visibly accelerated, despite the resumption in intra-city, intra-state, inter-state mobility being riddled with frequent roadblocks and fluctuations. While airlines, buses and on-demand cabs are still operating under 15% capacity and Trains yet to resume on PAN India routes, car rentals already recovering to 50-60% of pre-COVID demand validates the assertion that the category will see the swiftest recovery. It seems that the moment of reckoning for Car Rentals has arrived.

As Albert Einstein famously quoted- “In the midst of every crisis, lies great opportunity”.

About Savaari Car Rentals

Savaari is India’s leading chauffeur driven Car Rental Company with a PAN India presence, spread across 1800 cities. It boasts a solid track record of 14 years in the car rental industry with leading category Net Promoter Scores (NPS) of 45 and fulfillment rates of 99.7%. Its service offerings include intercity roundtrips, one way drops, hourly rentals and airport transfers. Operating both in the B2C as well as the B2B verticals (works with marquee partners like Makemytrip, Yatra and Aditya Birla Group), Savaari is uniquely positioned as a premier, reliable and organized car rental service provider. Savaari owns the complete rights on this India travel report by being the sole author.

Representatives from Savaari can be contacted at pr@savaari.com or www.savaari.com.

References in the India Travel Report

- UNWTO: International tourist numbers could fall in 2020

- Mckinsey: China’s travel restart after COVID-19

- Investment Week: China’s tourists step out again

- China Briefing: Tourism revival over Labour Day

- Ministry of Transport: May Day records 121M passengers

- China Travel News: Tourism shows signs of recovery

- ET: India’s tourism sector may lose Rs 5 lakh crores

- The Print: Government prepares to reopen the country

- TechCircle: Pandemic exposes vulnerabilities in OTAs

- TNIE: Some hotels may shut down permanently due to rising debt

- TNIE: Hotel industry revenue may fall by Rs 90K crores

- Auto Rental News: Is this car rental’s darkest hour?

- Livemint: 70% Indians to avoid public transport post lockdown

- Skift: 41% Americans prefer car for their first trip post COVID